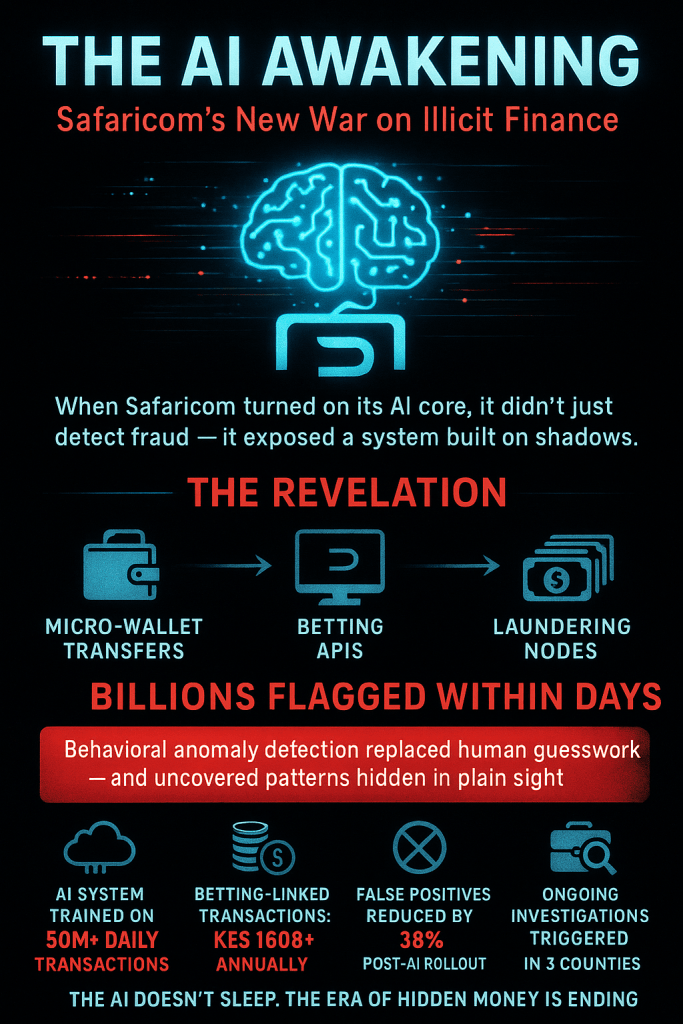

When Safaricom quietly switched on its new artificial intelligence engine earlier this year, no one expected it to rattle the country’s most powerful industry — or expose a side of M-Pesa no one was supposed to see. Within days, the system began lighting up with digital red flags: strange betting transactions looping through ordinary wallets, micro-deposits disguised as gaming payouts, and accounts moving small amounts in patterns too precise to be random. What the algorithms were seeing wasn’t play — it was laundering. Billions of shillings were silently being rinsed through Kenya’s favorite mobile platform, hidden beneath the guise of everyday betting. For weeks, engineers watched in disbelief as the AI’s alerts mapped a web of financial deception so intricate it blurred the line between entertainment and organized crime. The revelation shook Safaricom’s compliance teams — and soon after, the regulators who realized that Kenya’s most celebrated innovation had also become its most sophisticated laundering highway.

Inside Safaricom, a quiet revolution had begun. The company wasn’t just fighting fraud — it was reprogramming its financial DNA. The AI core, built in partnership with advanced compliance auditors and data scientists, doesn’t merely track transactions; it learns human behavior. It detects hesitation, timing anomalies, and wallet relationships that no manual audit could ever spot. What began as a compliance upgrade quickly turned into a forensic awakening — a self-learning system capable of catching what criminals believed was invisible. But the move also triggered backlash. Betting firms, some major ones, protested account freezes and accused Safaricom of overreach. Yet for Safaricom, this was no longer about risk — it was about survival. The same technology that made M-Pesa a lifeline for millions had made it a target for laundering syndicates. Turning AI loose on that frontier was less a choice than an inevitability.

Now, the discovery has thrown Kenya’s digital economy into uncharted territory. Regulators are scrambling to keep up, data privacy watchdogs are asking hard questions, and compliance officers are quietly celebrating the first real glimpse into the scale of illicit flows buried within mobile money. For the first time, artificial intelligence isn’t just assisting Kenya’s war on financial crime — it’s leading it. The system doesn’t sleep, doesn’t flinch, and doesn’t forget. And as it continues to learn, one thing is certain: the era of hidden money on M-Pesa is ending — but the reckoning it has triggered is only beginning. Stay tuned for the next post in this six-part series, where we will delve deeper into the implications of these changes.

References:

Techcabal How Safaricom’s AI exposed money laundering in Kenya’s betting boom

The Kenyan Wall Street How Safaricom is Leveraging AI to Bolster M-Pesa Security and Efficiency

Citizen Digital Father, son arrested for conning M-Pesa operators over Ksh.200K in Nairobi

KBC M-pesa outage on Monday as Safaricom adopts AI to tame fraud