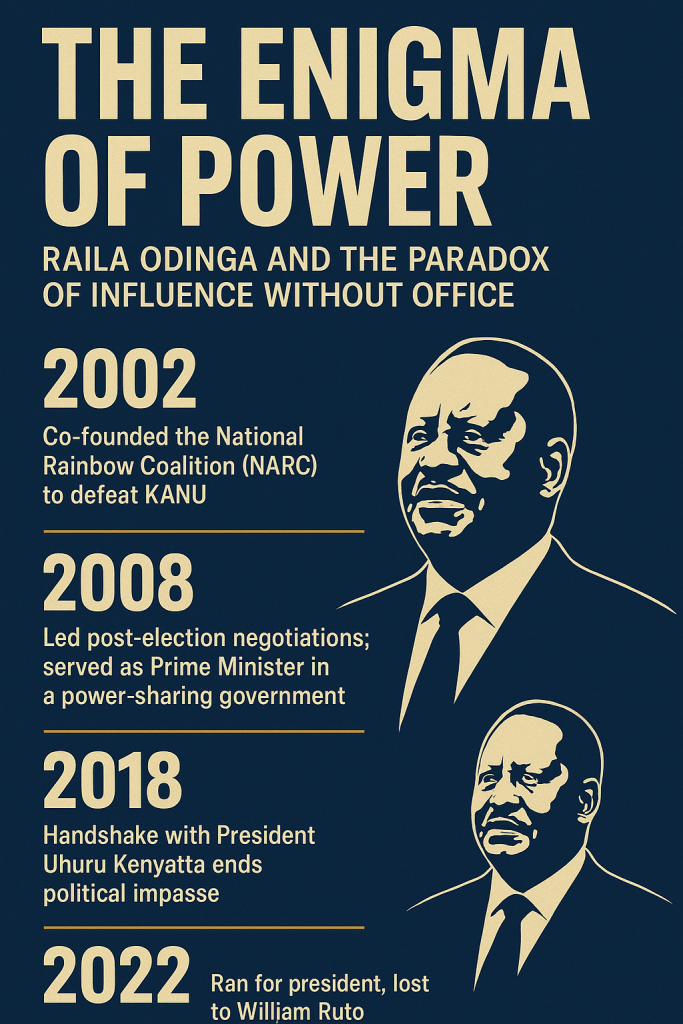

History rarely rewards those who come close — but in Raila Odinga’s case, proximity itself became the point of power. For more than four decades, Raila lived at the edge of power yet shaped every regime from within the shadows of opposition. He was, as The Africa Report aptly put it, “the man who lost every election but won Kenya’s democracy.” From the twilight of Daniel arap Moi’s rule to the dawn of Kenya’s multiparty renaissance, Raila’s defiance never waned — earning him both fear and reverence in equal measure. In 2002, when KANU’s dominance finally cracked, it was his dramatic declaration of “Kibaki Tosha” that propelled Mwai Kibaki to State House and ushered in the first peaceful transfer of power in Kenya’s history. Yet even in victory, Raila remained the outsider: betrayed by broken coalition promises, sidelined by those he helped elect. Still, he never relinquished the moral authority of the people’s voice. In 2005, his “Orange” movement defeated Kibaki’s draft constitution — a rare case of an opposition leader reshaping national destiny without holding office. And when the 2007 elections collapsed into violence, it was again Raila’s resilience that forced Kenya back from the brink, transforming a disputed vote into a dialogue for survival. Through pain, loss, and endurance, he became less a politician and more a barometer of Kenya’s democratic conscience — the man who could lose and still lead.

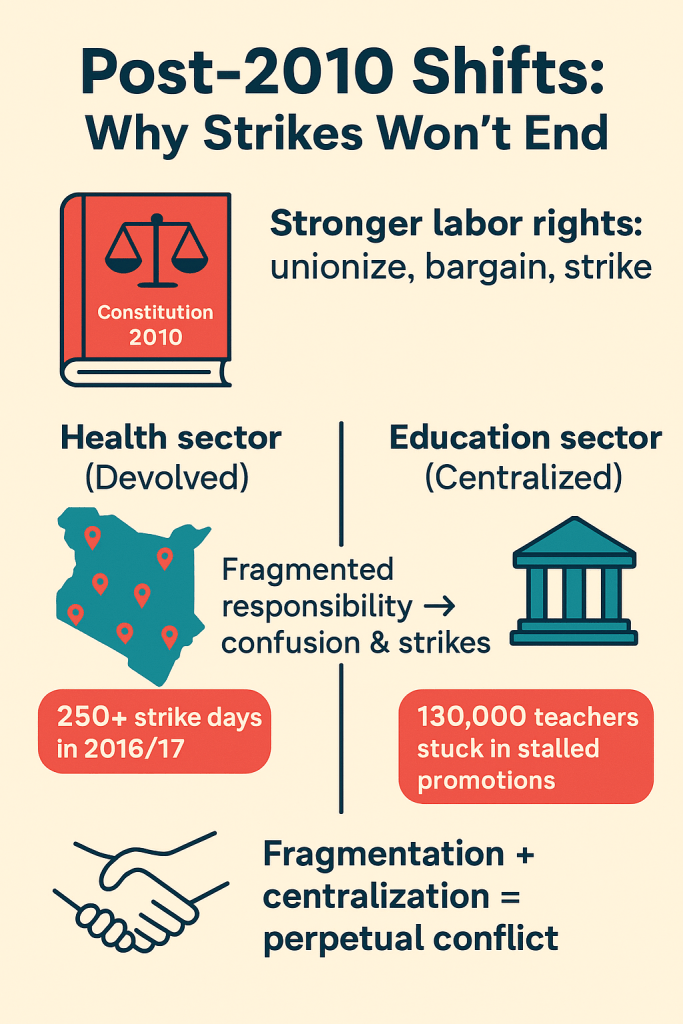

Raila’s power was never institutional; it was cultural, narrative, and profoundly human. He understood Kenya’s pulse — and weaponised symbolism like few before him. His aliases — Agwambo, Tinga, Baba — transcended politics, morphing into collective identities of resistance, belonging, and hope. His supporters saw in him their own unfulfilled promise; his rivals, a reminder that legitimacy cannot be decreed. Each administration that followed — from Kibaki to Kenyatta to Ruto — has been shaped, challenged, or legitimised by Raila’s political presence. As Prime Minister in the 2008 Grand Coalition, he co-supervised the nation’s reconstruction after post-election chaos and championed reforms that birthed the 2010 Constitution — arguably his greatest institutional legacy. That charter redefined Kenyan governance, devolving power to the counties and embedding civil rights into law, echoing the principles for which he had once been jailed. Later, his controversial 2018 “Handshake” with President Uhuru Kenyatta ended months of unrest following the disputed 2017 polls and restored political calm — though it also fractured his traditional support base. Yet, even that act reinforced his lifelong philosophy: that peace, not position, defines statesmanship. His later appointment as the African Union’s High Representative for Infrastructure confirmed his continental stature — a statesman recognised beyond Kenya’s borders for blending political endurance with technocratic vision.

In the end, Raila Odinga’s paradox was not that he failed to capture the presidency, but that he redefined what power itself means in a fragile democracy. His defeats never diminished his influence; they amplified it. Every president who took office did so under the long shadow of his moral authority. He forced institutions to evolve, compelled courts to assert independence, and transformed the vocabulary of opposition into the grammar of governance. In his twilight years, even adversaries acknowledged that Kenya’s political story could not be told without him — that every victory or reform bore his fingerprints somewhere beneath the surface. He was both architect and agitator, healer and heretic, rebel and reformer. Raila Odinga never occupied State House, but he changed what it stood for — from a fortress of fear to a house answerable to its citizens. And as the nation continues to wrestle with the legacy of leadership and legitimacy, his life offers a sobering truth: that true power is not seized, but earned — and sometimes, it lives longest in the hands of those who never hold the crown.

References:

The Africa Report Raila Odinga: The man who lost every election but won Kenya’s democracy

The Star Raila Odinga: The man who changed Kenya without ever ruling it

The Star Most consequential politician in history of Kenya bows out

All Africa Kenya Mourns Raila Odinga ‘The President’ It Never Had

TRT World Raila Odinga: Kenya’s political enigma never left the stage