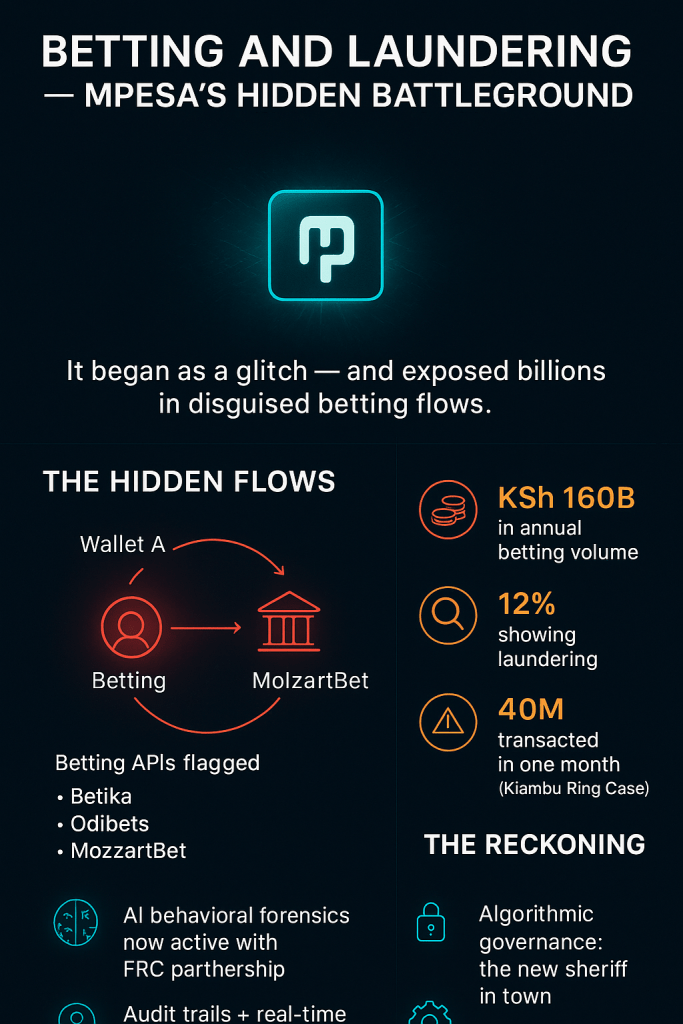

It began as a flicker of digital noise deep within Safaricom’s new artificial intelligence compliance system — a pattern so strange, even the engineers thought it was a software glitch. Betting wallets were trading in micro-loops, small deposits bouncing across networks at impossible speed, masquerading as gaming wins. But when the algorithm slowed the data stream, it exposed the truth: this wasn’t gambling; it was laundering. In days, Safaricom’s AI had flagged dozens of high-traffic betting APIs — among them Betika, Odibets, and MozzartBet — for suspicious activity, their systems pulsing with repeated micro-transactions that defied legitimate gaming behavior. What the model revealed was staggering. Ordinary player wallets had become conduits for billions of shillings, circulating under the guise of lucky streaks. Behind every spin, every small bet, was a meticulously choreographed web of digital cash-washing. The machine had finally confirmed what regulators long suspected but could not prove: Kenya’s fast-rising betting culture had evolved into the perfect laundromat — one hidden in plain sight inside the M-Pesa ecosystem.

The numbers told their own story. In the Kiambu Betting Ring case, investigators uncovered agents processing over KSh 40 million in just one month, using layered deposits and false payout slips to disguise dirty money as betting gains. Similar patterns appeared in the MozzartBet compliance freeze of mid-2024, where offshore cash-outs linked to unverified wallet owners triggered intervention by the Financial Reporting Centre (FRC) and Central Bank’s AML unit. By then, the data was irrefutable. AI modeling suggested that nearly 12 percent of Kenya’s annual betting volume — roughly KSh 160 billion — showed characteristics of laundering or structured fraud. The algorithms traced wallet behaviors that no manual audit could — bettors who “won” every day without ever placing bets, agents whose transaction volumes exceeded physical limits, and accounts that went dark after a single large payout. These were not random outliers; they were engineered identities, designed to game a system built for speed, not scrutiny. For years, M-Pesa’s success story — its promise of instant, borderless convenience — had inadvertently created the perfect storm: a seamless digital infrastructure exploited by syndicates more agile than the law itself.

Now, that same infrastructure is being weaponized against them. Safaricom’s AI partnership with the FRC has ushered in a new era of behavioral forensics — algorithms that don’t just track money but interpret motion, timing, and correlation. Yet this technological awakening has sparked backlash. Betting firms accuse Safaricom of overreach, freezing legitimate transactions and blurring the line between compliance and surveillance. Regulators, meanwhile, are tightening the screws: audit trails for all gaming wallets, mandatory KYC verification, and real-time data access for AML enforcement. The ripple effects extend far beyond gaming. Kenya’s digital economy now stands at an inflection point, where algorithmic oversight has become both protector and disruptor. In exposing how entertainment masked economic deceit, the AI has done more than flag fraudulent wallets — it has held up a mirror to the fragility of digital trust in a cashless nation. The house may always win, but in this new frontier, so does the machine — and its vision is only getting sharper.

References:

Techcabal Safaricom fires 113 employees over fraud as internal cases rise

KBC Channel 1 Kenya’s gambling industry set for shake-up after President Ruto signs into law Gambling Control Bill (Youtube)

The Kenyan Wall Street How Safaricom is Leveraging AI to Bolster M-Pesa Security and Efficiency

KBC M-pesa outage on Monday as Safaricom adopts AI to tame fraud