Kenya is boldly stepping into the digital finance arena by moving to legalize cryptocurrencies, marking a departure from its previously restrictive stance on digital assets. Driven by Treasury Cabinet Secretary John Mbadi, this initiative aims to capture the economic potential of the burgeoning underground crypto market. The proposed regulatory framework seeks to strike a balance between fostering innovation and ensuring robust consumer protection, addressing risks such as money laundering and cybercrime. By leveraging its advanced mobile money infrastructure, Kenya plans to integrate blockchain technology into key areas such as logistics and supply chain management, enhancing transparency and efficiency.

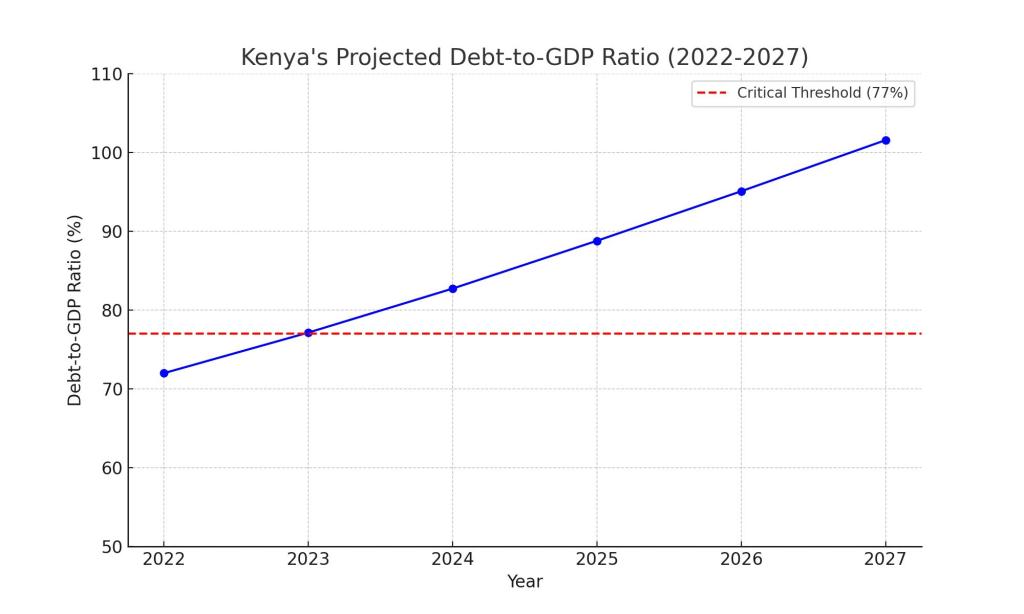

The country’s strategic push positions it to lead in digital finance, aiming to enhance financial inclusion and streamline international trade through a competitive cryptocurrency market. Central to this effort is the adoption of global standards, as emphasized by the International Monetary Fund (IMF), which advises aligning Kenya’s regulatory framework with international norms including the IMF/World Bank Bali Fintech Agenda. The framework should address existing risks and enhance cross-sector cooperation for market oversight. It underscores the need for legal certainty and cross-border regulatory arrangements. Additionally, the government must focus on financial literacy to safeguard against scams, as it also seeks to increase tax revenues from the crypto sector, targeting KSh 60 billion, a significant rise from the previous KSh 10 billion.

Despite these ambitions, challenges remain, particularly concerning infrastructure gaps and low public awareness of cryptocurrency risks. The volatility of digital currencies also poses challenges for investors. The government is prioritizing education and navigating internal debates over regulations like the Capital Markets (Amendment) Bill 2023. Kenya’s actions mirror a wider continental trend, joining African nations such as Nigeria, where stablecoins are combating inflation, and South Africa, which is blending traditional finance with cryptocurrency under clear regulatory guidance. Kenya stands at a pivotal juncture, poised to reshape its economic landscape while setting a standard for digital innovation and regulation across Africa. Through strategic implementation and international collaboration, Kenya is geared to lead Africa into a new era of digital finance.

References:

Finance Magnates Kenya Drafts Policy to Legalize Cryptocurrencies, Expand Digital Economy

Live Bitcoin News Kenya Plans to Legalize Cryptocurrencies with New Policy

Africa Logistics Kenya’s Move to Legalize Cryptocurrency: A Game-Changer for Logistics in Africa

Africa Tech Summit The State of Crypto in Kenya

Business Daily Kenya moves to regulate Bitcoin trade on grey listing risk

Crypto Briefing Kenya set to legalize crypto, says Finance Minister John Mbadi

Cointribune Crypto: IMF Urges Kenya to Align with Global Regulations

The Star Kenya’s Digital Gold Rush: The Rise of Cryptocurrency Trading

MSN IMF lists recommendations to manage crypto in Kenya, offers to support govt in policy framework

Observer Voice IMF Urges Kenya to Strengthen Crypto Regulations

Business Daily Why Kenya should prioritise passing of crypto regulations