Kenya’s relationship with the International Monetary Fund (IMF) has been a contentious topic, especially due to the economic conditions tied to IMF loans that impact ordinary Kenyans. The tension has escalated recently with protests against tax hikes, which many Kenyans view as a direct consequence of the IMF’s conditions. This unrest highlights the public’s frustration with both the government’s economic policies and the IMF’s role in shaping them. The IMF’s involvement in Kenya is seen as a double-edged sword; while it provides necessary financial assistance, it also imposes stringent conditions that many feel exacerbate economic inequality and hardship. Public outcry has particularly focused on how these conditions seem to undermine national sovereignty, with citizens questioning the long-term implications for Kenya’s economic independence.

The IMF has a long history of providing financial assistance to Kenya, most recently through a $2.34 billion arrangement aimed at supporting economic recovery from the COVID-19 pandemic, addressing debt vulnerabilities, and fostering inclusive growth. However, the stringent conditions attached, including austerity measures and increased taxes, have been deeply unpopular. The proposed Finance Bill 2024/2025, which sought to introduce new taxes to meet fiscal targets under the IMF program, became a flashpoint, leading to widespread protests and fatal clashes, ultimately forcing the government to withdraw the bill. These protests, largely driven by the Gen-Z demographic, reflect broader issues of governance, corruption, and public expenditure management. There are growing calls for the government to focus more on reducing wastage and corruption rather than increasing taxes, highlighting the public’s demand for more responsible and transparent governance.

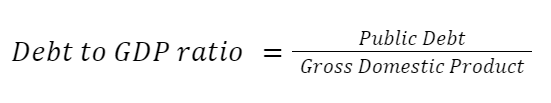

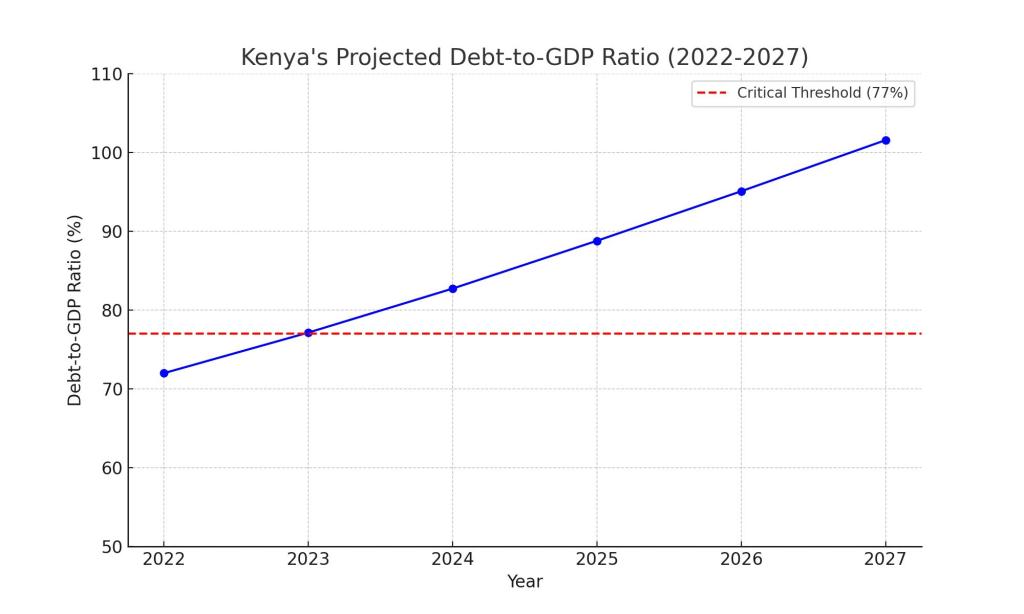

Kenya’s economic challenges are multifaceted, with high debt levels and public debt nearing 70% of GDP. While the IMF’s involvement is seen as crucial for maintaining financial stability, its prescriptions are often viewed as disproportionately affecting the poor and middle class. President William Ruto’s government is in a difficult position, needing to balance the IMF’s demands with public discontent. Following the protests, Ruto had to assure both the IMF and his citizens that Kenya would still meet its fiscal goals through alternative means, such as budget cuts and increased borrowing. This situation underscores the complex dynamics between national policies and international financial institutions’ requirements. The IMF’s influence in Kenya has become a rallying point for various social and political movements, with many feeling that its programs benefit financial stability at the cost of social stability and public welfare. Protesters see the IMF as an external force imposing harsh economic policies without fully understanding the local context and hardships faced by ordinary Kenyans, echoing a broader critique of the IMF’s role in developing countries. This sentiment underscores the need for sustainable economic growth that maintains social harmony and effectively addresses public grievances.

References:

The National Treasury and Economic Planning KENYA-IMF PROGRAM

International Monetary Fund IMF Statement on Kenya