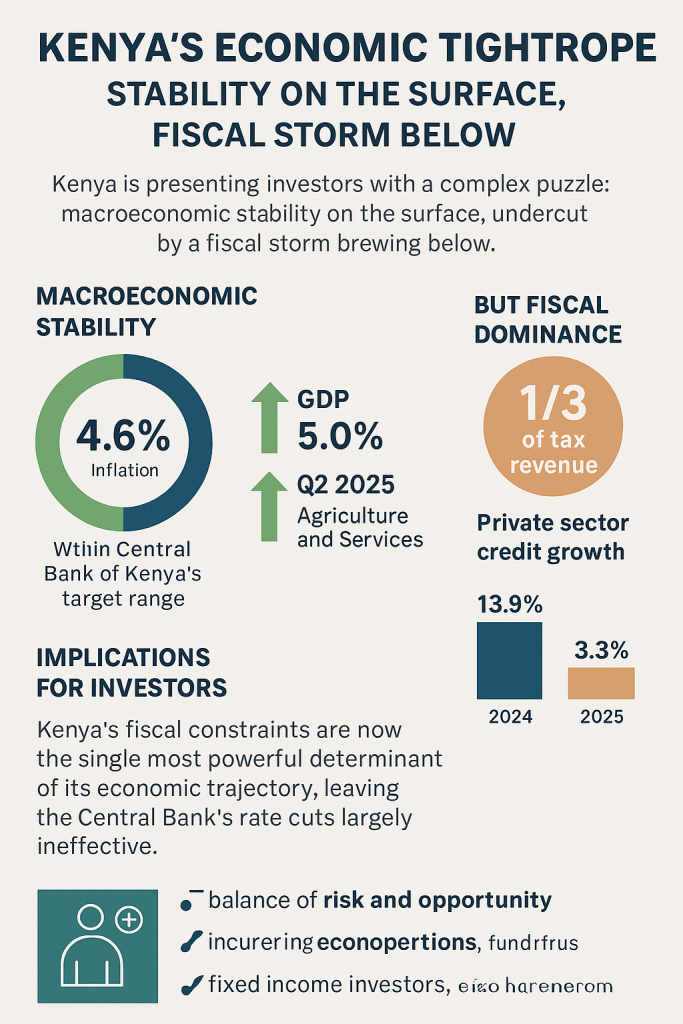

Kenya’s economy is presenting investors with one of its most complex puzzles yet: macroeconomic stability on the surface, undercut by a fiscal storm brewing beneath. Inflation stands at a steady 4.6%—comfortably within the Central Bank of Kenya’s target range—granting policymakers room for monetary easing. GDP data also reflects resilience, with Q2 2025 growth at 5.0%, led by agriculture and a robust services sector. Yet behind these encouraging numbers lies a sobering reality: fiscal dominance. With interest payments now consuming roughly a third of all tax revenue, the government’s borrowing appetite is crowding out private credit. Commercial banks, chasing high-yield government paper, have little incentive to lower lending rates for businesses, leaving private sector credit growth crippled at barely 3.3%, down from 13.9% just a year ago.

This squeeze is not just an abstract statistic; it defines the contours of Kenya’s medium-term investment landscape. The government projects a 5.3% full-year expansion, but global institutions remain unconvinced. The IMF and World Bank forecast growth at 4.8% and 4.5% respectively, citing weak private sector consumption, a sluggish credit channel, and a high risk of debt distress. Kenya’s fiscal constraints are now the single most powerful determinant of its economic trajectory, leaving the Central Bank’s rate cuts largely ineffective. The implication for investors is clear: headline GDP growth masks a structural imbalance where state borrowing sets the price of credit and private enterprise takes a back seat.

The balance of risk and opportunity lies in how investors position themselves. Kenya’s external buffers—rising remittances, strong agricultural exports, and narrowed current account deficit—are encouraging, but remain fragile, as all three are highly exposed to global downturns. For fixed income investors, short-duration government paper offers yield but carries sovereign risk that cannot be ignored. For equities, defensive plays in export-driven agribusiness, technology, and digital services stand out, while firms reliant on domestic mass-market credit may falter. Direct investment opportunities exist in renewable energy, climate-linked finance, and tech, sectors less tied to domestic fiscal strain. For corporate strategists, survival hinges on operational efficiency, alternative financing, and robust risk management to cushion external shocks. Kenya stands at a decisive juncture: without credible fiscal consolidation, its growth story risks becoming a cycle of constrained resilience. For investors, the key lies not just in reading the numbers, but in recognizing the limits of resilience when credit and capital are structurally captured by the state.

References:

KNBS Inflation Rate (CPI)

CNBC Africa Kenya’s inflation rises slightly in September on food, transport

World Bank Group Despite Improvements, Kenya’s Fiscal Path is Fragile Amid High Debt Vulnerabilities and Weak Revenue Growth