The shilling has weakened against major international currencies, continuing to cost firms, and in the long run, the consumers. Firms buying raw materials in foreign currencies have been forced to factor in an element of exchange-rate in their production costs hence, the rise in prices of products and services. When prices rise, each unit of currency buys fewer goods and services thus the decrease in real value for money and monetary items over time. Most production firms rely on the energy sector; for instance, Kenya Power and Ken Gen buy oil in US dollars, and have to factor in depreciation of the Kenyan shilling, in the cost of production, thus, consumers feel the effects of the weakening shilling in paying higher electricity tariffs.

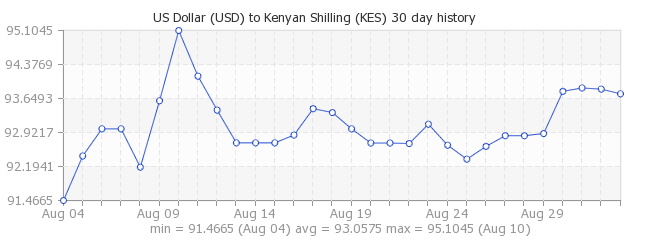

A weak shilling

High rates of inflation lead to inefficiency in a market economy and, in the medium to long term, a lower rate of economic growth. Movements in the general price level are influenced by the amount of money in circulation, and productivity of the various economic sectors. The Central Bank of Kenya regulates the growth of the total money stock to a level that is consistent with a predetermined economic growth target as specified by the Government and outlined in its Monetary Policy Statement. Inflation reduces the value of money thus; a currency will depreciate in value. Firms will try to exchange the Kenyan shilling for other currencies, which will hold value, thus, causing the shilling to weaken. To finance large National debts, the government may sometimes print more money causing a surge in inflation. When a country imports more goods and services than it exports, it causes a currency account deficit. To finance this deficit, the government will require a surplus on the financial/capital account, by attracting capital flows e.g. Iceland had a current account deficit of around 7% of GDP, their banks had higher interest rates thus attracted UK councils to save their money in the Icelandic banks. Because of the capital inflows from abroad, the Icelandic economy could continue to finance its current account deficit. However, the problem comes when; a country can no-longer finance this deficit, when the country can no longer attract capital inflows. Due to economic recession in Iceland, there was more money leaving Iceland than coming in. This was reflected in the exchange rate. When capital inflows dry up this will actuate depreciation in the exchange rate.

If there is a collapse in confidence in an economy, or the financial sector, this will lead to an outflow of currency as people don’t want to risk losing their value for money. Therefore this causes an outflow of capital and depreciation in the exchange rate.

| Currency | Mean | Buy | Sell | Date | |

| 1 | US DOLLAR | 93.1361 | 93.0306 | 93.2417 | 18.Aug.2011 |

| 2 | STG POUND | 153.8709 | 153.6775 | 154.0643 | 18.Aug.2011 |

| 3 | EURO | 134.0925 | 133.9261 | 134.2589 | 18.Aug.2011 |

| 4 | SA RAND | 13.0786 | 13.0508 | 13.1064 | 18.Aug.2011 |

| 5 | KES/USHS | 29.8758 | 29.7078 | 30.0439 | 18.Aug.2011 |

| 6 | KES/TSHS | 17.4477 | 17.3742 | 17.5211 | 18.Aug.2011 |

| 7 | AE DIRHAM | 25.3577 | 25.3275 | 25.3878 | 18.Aug.2011 |

| 8 | JPY(100) | 121.5086 | 121.3185 | 121.6987 | 18.Aug.2011 |

| 9 | CHINESE YUAN | 14.5826 | 14.5654 | 14.5998 | 18.Aug.2011 |

Forex Market Indicative Rates for Major Currencies (Opening of Markets)

References:

Inflation Wikipedia.org August 18, 2011

Consumer Price Index Google Docs (as of) August 18, 2011

Electricity Bills May Go Up-Again allAfrica.com August 18, 2011