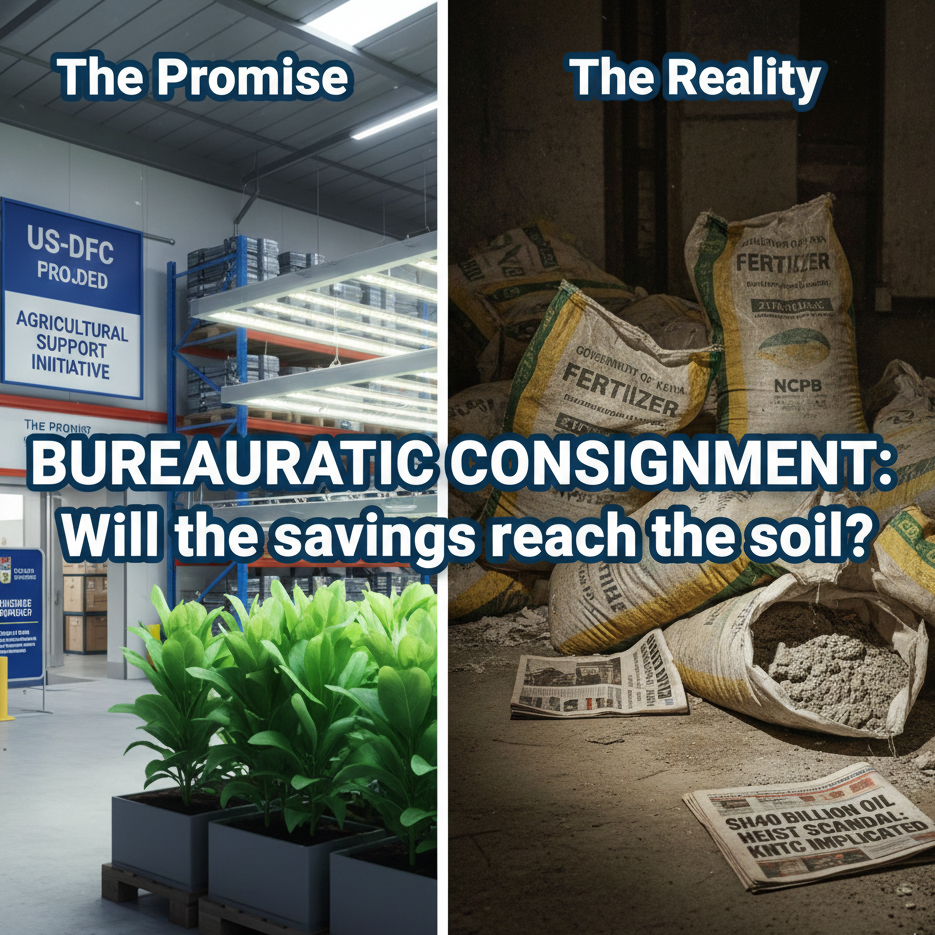

The “Food-for-Eurobond” deal relies on a dangerous assumption: that savings from international debt relief can navigate the treacherous waters of Kenya’s local bureaucracy without being looted. History suggests this is an “oil and water” scenario—liquid finance attempting to mix with a rigid, opaque system. The recent scandals at the Kenya National Trading Corporation (KNTC) and the National Cereals and Produce Board (NCPB) serve as grim warnings. In the KNTC edible oils scandal, tax waivers meant to lower prices were captured by politically connected firms, resulting in a Sh16.5 billion loss with no benefit to the consumer.

Similarly, the NCPB’s recent distribution of “fake fertilizer”—bags filled with quarry dust—demonstrates how easily “agricultural support” can be weaponized against the farmers it is meant to help. If the swap funds are channeled through these same “bureaucratic consignments,” the initiative risks becoming another slush fund for cartels. The involvement of the World Food Programme (WFP) is intended to act as an “emulsifier,” forcing accountability into the system, but their oversight powers will be tested against deeply entrenched patronage networks.

Experts warn that without a radical overhaul of state agencies, the “savings” will evaporate before they buy a single bag of genuine fertilizer or build a working silo. The structural disconnect between the Treasury’s high-level deal-making and the Ministry of Agriculture’s operational failures remains the single biggest risk. Unless the government bypasses these compromised intermediaries, perhaps by funding private sector credit guarantees instead of direct procurement, the “oil” of finance will float to the top, leaving the “water” of development murky and stagnant.

References:

Milling Middle East & Africa Kenya’s edible oil scandal raises questions over accountability, transparency

AP Farmers in Africa say their soil is dying and chemical fertilizers are in part to blame