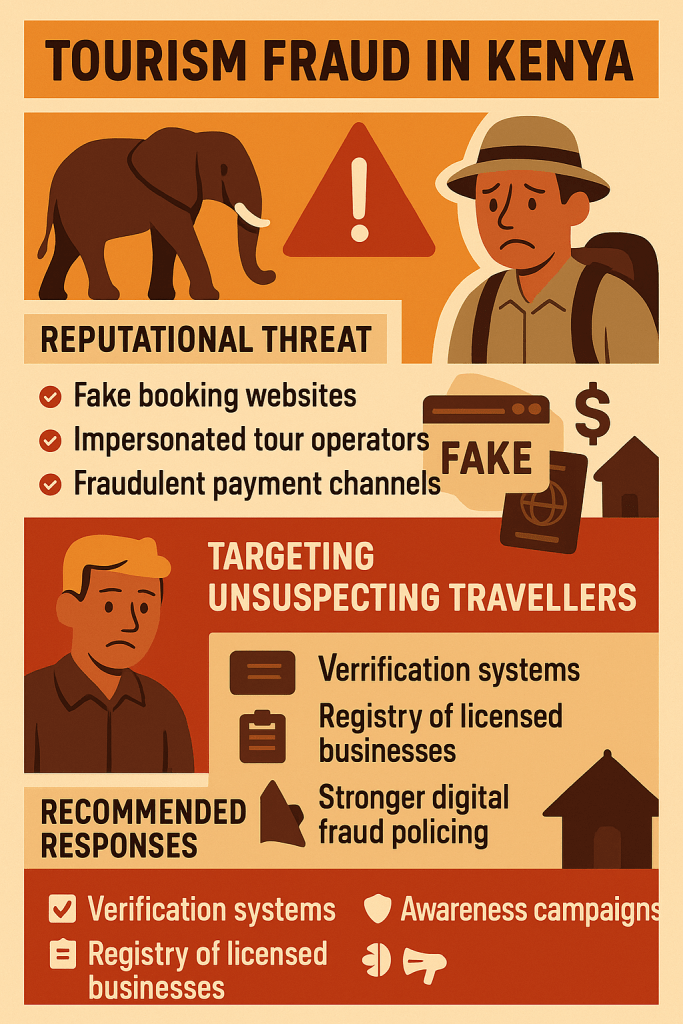

Kenya’s tourism industry, a vital pillar of the economy and a top foreign exchange earner, is now battling a growing reputational threat: sophisticated fraud targeting unsuspecting travelers. According to the latest sector review, a surge in fake booking websites, impersonated tour operators, and fraudulent payment channels is eroding visitor trust and undermining the gains made in post-pandemic recovery. Many of these scams operate with alarming polish—using stolen branding, cloned websites, and even counterfeit licenses to lure victims into paying for non-existent safaris, hotel stays, or cultural tours. Victims, often diaspora Kenyans and international tourists planning high-value itineraries, only discover the deceit upon arrival, when their bookings prove fake and their funds unrecoverable. The Kenya Tourism Board (KTB) and sector associations have flagged these schemes as a systemic risk that, if unchecked, could tarnish Kenya’s image as a safe, reliable destination.

Industry stakeholders stress that the challenge is compounded by gaps in regulatory oversight, slow cross-border law enforcement cooperation, and limited consumer awareness in key source markets. Fraudsters exploit these vulnerabilities, targeting peak travel seasons and leveraging digital marketing channels to reach large audiences with minimal traceability. Tour operators report that such scams not only cause financial loss but also drive potential travelers toward competing destinations perceived as safer or better regulated. Its important to note that while Kenya’s tourism marketing campaigns have successfully reignited global interest, this momentum risks being reversed if fraud-related horror stories dominate travel forums and social media. Experts recommend a multi-pronged response: real-time verification systems for operators, a central registry of licensed tourism businesses accessible to the public, stronger digital fraud policing, and targeted awareness campaigns in both domestic and foreign markets.

To its credit, the government has begun aligning with these recommendations, with the Ministry of Tourism working alongside the Communications Authority, cybercrime units, and private-sector stakeholders to roll out verification platforms and consumer education drives. Pilots for an online “Tourism Trust Mark” are already underway, enabling travelers to authenticate operators before making payments. Additionally, diplomatic missions are being engaged to circulate fraud alerts in high-risk markets, while tourism associations are exploring partnerships with payment processors to flag suspicious transactions. These initiatives, if scaled and sustained, could restore confidence and reinforce Kenya’s brand as a secure, trustworthy destination. In an increasingly competitive global tourism landscape, safeguarding the integrity of the travel experience is no longer optional—it’s a prerequisite for growth. Kenya’s long-term competitiveness will hinge not just on the beauty of its landscapes, but on the trustworthiness of the path visitors take to reach them.

References:

Kenyans.co.ke DCI Arrest Suspect After Greek Tourist Loses Ksh3.6 Million in Maasai Mara Scam

Government of Canada Kenya travel advice

Action Fraud Kenya Romance Scam

Shian Safaris How to Avoid Being Conned on Your Travels in Kenya