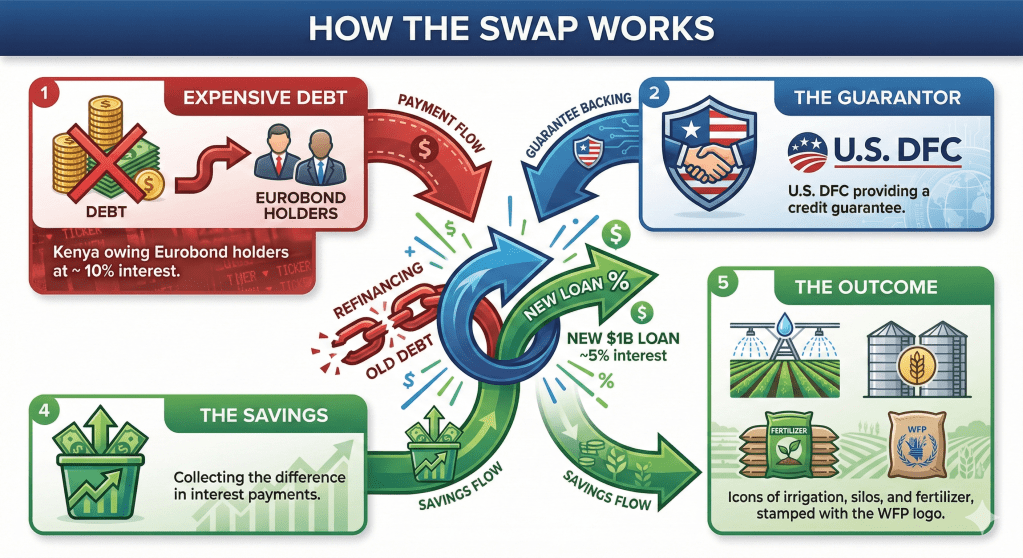

Kenya is on the verge of finalizing a landmark $1 billion (Sh129 billion) debt-for-food security swap, a sophisticated financial maneuver designed to rescue the country from a suffocating liquidity crunch. By leveraging a guarantee from the U.S. International Development Finance Corporation (DFC), the Treasury intends to refinance expensive Eurobond debt with cheaper, concessional loans. The plan is financially astute: it swaps high-interest commercial debt for lower-interest obligations, a move that prompted Moody’s to upgrade Kenya’s credit rating to B3 and stabilize the outlook on the nation’s sovereign debt.

However, the deal comes with a catch that transforms it from a simple refinancing operation into a complex development experiment. The interest “savings” generated from this swap must be ring-fenced and funneled directly into food security projects, managed in partnership with the World Food Programme (WFP). This arrangement effectively outsources a portion of national planning to an international body, admitting that the state needs external discipline to ensure funds aren’t diverted. While this stabilizes the shilling and pleases bondholders, it raises a fundamental question: is this a genuine strategy to feed the nation, or simply financial engineering to avoid default?

The stakes could not be higher. With 3.4 million Kenyans facing acute food insecurity and public debt service consuming over two-thirds of tax revenue, the government is betting that this “financial oil” can mix with the “water” of local agriculture without separating. If successful, it provides fiscal breathing room and lowers input costs for farmers; if it fails, Kenya will be left with the same debt burden and no improvement in the cost of living for the average wananchi.

References:

Business Insider Africa Kenya plans to borrow $1 billion using debt for food swap

CNBC Africa Kenya, US agency to proceed with $1 billion debt-for-food swap