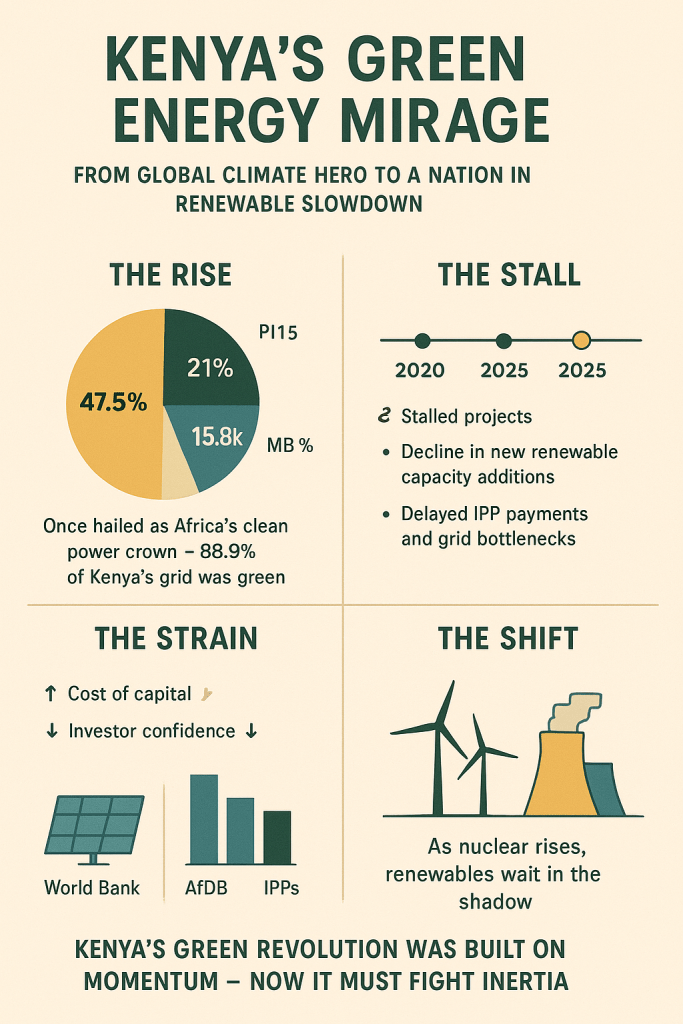

For years, Kenya stood as a global symbol of clean energy success — a nation that proved Africa could power progress without burning its future. With nearly 90% of its electricity drawn from renewables, Kenya’s geothermal fields, hydropower dams, and wind farms once made headlines as the triumph of policy discipline and natural endowment. Yet today, that narrative is faltering. Behind the statistics lies a quiet stagnation. Few major renewable projects have been commissioned since the early 2020s, while others — like Menengai Geothermal and Lake Turkana Wind — have suffered delays, funding gaps, and regulatory setbacks. Grid instability and transmission shortfalls have worsened, creating a paradox: Kenya generates green energy, but struggles to distribute it efficiently or expand access affordably. What was once the continent’s clean energy beacon now risks dimming into complacency.

The chill is most visible in the financing landscape. Kenya’s renewable push was built on concessional lending and development partnerships — a model now straining under fiscal pressure and global credit tightening. According to the World Bank and IEA, the cost of capital for African energy projects has risen sharply, even as debt distress restricts new borrowing. This has slowed project pipelines and rattled investor confidence. Independent Power Producers (IPPs), once seen as catalysts of the renewable surge, now face payment delays and opaque contract reviews that threaten future participation. In solar and mini-grid development — once the pride of Kenya’s rural electrification drive — progress has stalled under mounting bureaucracy and reduced donor enthusiasm. The result is a deep irony: a country rich in green potential but starved of green liquidity. The geothermal wells still steam, but the flow of financing and political focus has cooled.

Kenya’s pivot toward industrial-scale projects — including its ambitious nuclear agenda — risks further diluting the urgency once attached to renewables. Policy attention and investor courting now lean heavily toward centralized megaprojects, sidelining community-level innovation and decentralized energy solutions that had made Kenya’s progress unique. Meanwhile, regional rivals such as Ethiopia and Morocco are racing ahead with diversified, well-financed renewable strategies. Kenya’s hard-won first-mover advantage is eroding, not from technological failure but from strategic drift. Without renewed investment in transparent governance, private-sector trust, and equitable policy incentives, the nation’s celebrated “green crown” could fade into a mirage of past glory — a relic of what once was. And as Kenya’s energy gaze shifts from wind and steam to uranium and reactors, the next big question looms large: why does clean power still cost so much?

References:

IEA Kenya’s energy sector is making strides toward universal electricity access, clean cooking solutions and renewable energy development

IEA How a high cost of capital is holding back energy development in Kenya and Senegal

Daily Nation GDC loses battle with Menengai residents over drilling projects

African Development Bank Group Kenya – 35MW OrPower Menengai Geothermal Power Project – P-KE-FA0-027