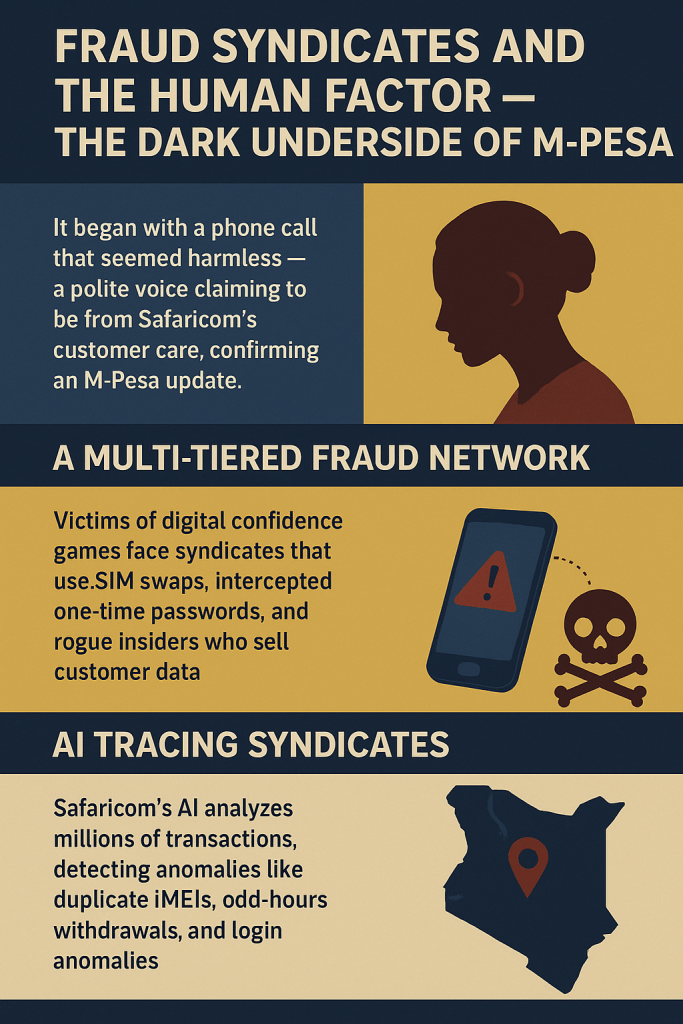

It began with a phone call that seemed harmless — a polite voice claiming to be from Safaricom’s customer care, confirming an M-Pesa update. Within minutes, Jane, a market trader from Nakuru, had lost everything in her wallet: her savings, her chama contributions, her business float. Hers wasn’t an isolated case. Across Kenya, from Kisumu to Kitengela, stories like Jane’s unfold daily — victims of digital confidence games that prey on trust and technological gaps. Beneath the convenience of Kenya’s mobile-money revolution lies a dark economy of cloned SIM cards, intercepted one-time passwords, and rogue insiders who sell customer data. What used to be petty phone scams has evolved into a multi-tiered fraud network, often coordinated through WhatsApp and Telegram groups, blending social engineering with technical precision. By the time victims realize their wallets have been emptied, the syndicates have already moved the money — split it, layered it, and cleaned it across dozens of M-Pesa accounts in seconds.

Behind the scenes, Safaricom’s AI compliance core is racing to keep up. Its models analyze millions of daily transactions, searching for irregular velocity, mirrored wallet behaviors, or login anomalies that betray coordinated fraud. The patterns are hauntingly human — the same phone IMEI used across unrelated accounts, repeated deposits at odd hours, or withdrawals made seconds after password resets. Investigators have identified rogue M-Pesa agents who act as the final cash-out nodes in this digital laundering chain, turning stolen virtual funds into physical currency. In one 2024 case in Eastlands, a syndicate of former call-centre employees was arrested after siphoning KSh 27 million from unsuspecting users — all through identity swaps and internal credential misuse. AI has since helped trace such insider leaks, tagging compromised agent IDs and disabling accounts that exhibit duplicate fingerprints. But even as the system grows smarter, so do the fraudsters, adapting to its logic, learning from its lags, and exploiting the tiniest cracks in Kenya’s fintech armor.

The war against M-Pesa fraud has thus become as much psychological as it is technological. For every line of defense built by machine learning, a counter-strategy emerges in the human domain — manipulation, deceit, and insider temptation. Regulators and investigators now warn that Kenya’s digital integrity hinges not only on code, but on culture — ethics, awareness, and enforcement. Safaricom has begun rolling out human-centered safeguards: community alerts, biometric verification pilots, and tighter collaboration with law enforcement. But the real test is whether ordinary Kenyans, from traders to teachers, can trust a system where the threat no longer comes from distant hackers but from within their own networks. The digital revolution gave Kenya financial freedom; now it must reckon with the predators it empowered. In our next post, we’ll explore the growing debate between privacy and security — and how Kenya’s AI revolution is forcing a reckoning over who really controls your data.

References:

Techcabal Safaricom fires 113 employees over fraud as internal cases rise

Techcabal How Safaricom’s AI exposed money laundering in Kenya’s betting boom

Rest of World M-Pesa has been huge for Kenya’s economy — and for scammers

Techpoint Africa Investigating M-PESA fraud cases in Kenya