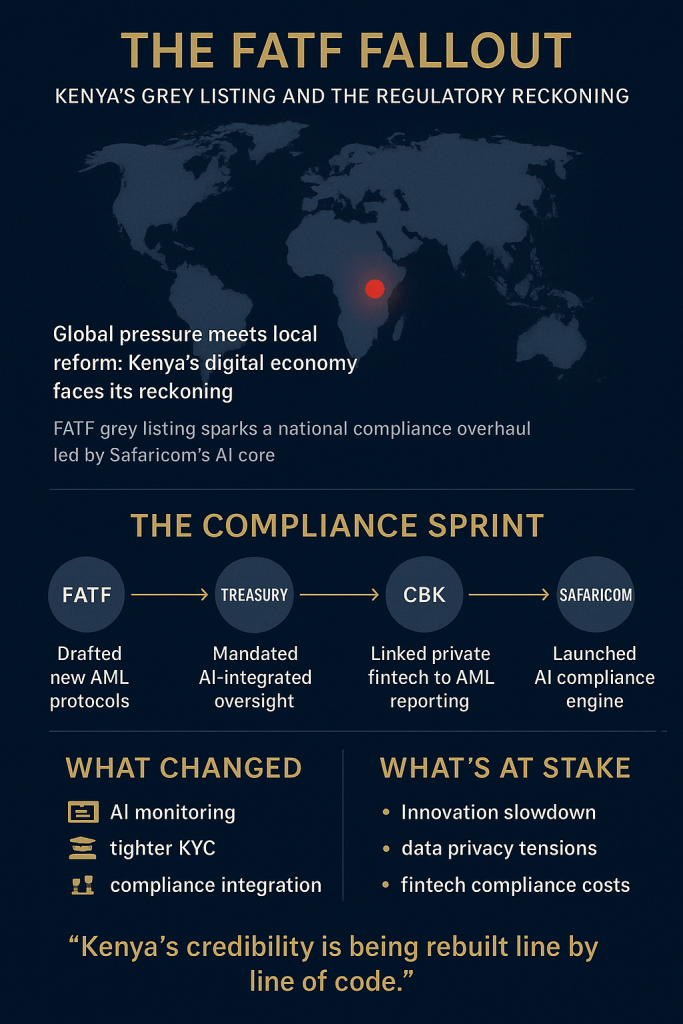

When Safaricom deployed its AI compliance engine, it wasn’t just about technological advancement — it was about survival. Behind the polished rollout was a growing alarm: Kenya had been placed on the Financial Action Task Force’s grey list in February 2024, forcing a reckoning over AML/CFT deficiencies exposed by international watchdogs. The grey listing exposed severe gaps: weak beneficial ownership disclosure, minimal prosecutions of money laundering, and under-regulation of sectors at high risk, including gambling, real estate, non-profit organisations, virtual assets, and law firms. Safaricom, already under pressure, recognized that its standing as the country’s digital financial backbone (through M-Pesa) meant that mere innovation would not suffice without credible compliance. The company’s AI overhaul was not a strategic choice — it was a compliance lifeline in a context where global trust, investor confidence, and even Kenya’s regional financial status were on the line.

The government’s response post-grey-listing was fast but fraught. On 17 June 2025, Kenya passed the new Anti-Money Laundering and Combating Terrorism Financing Act, strengthening the mandate of the Financial Reporting Centre (FRC) to oversee not just banks but non-financial businesses, regulated gambling operators, and high-risk non-profit entities. New requirements for beneficial ownership transparency, risk-based supervision, enhanced due diligence for high-risk customers, and stricter reporting of suspicious transactions were added. Yet, FATF’s June 2025 monitoring statement makes clear: Kenya is still under close watch. The list of obligations under “increased monitoring” remains long: non-financial entities must be better regulated; virtual asset service providers must be accounted for; suspicious transaction reports must rise; enforcement must reach even the high and powerful. The risk is no longer about drafting laws, but whether those laws bite.

But the FATF fallout isn’t only about compliance checkboxes—it’s rewriting Kenya’s fintech ecosystem. Startups, betting firms, M-Pesa agents, virtual asset operators are now navigating a regulatory terrain that demands transparency in ownership, speed in auditing, and an ever-watchful AI lens on behavior. The pushback has begun: fears of overreach, regulatory burden, and challenges for small operators. Still, for the first time in years, Kenya’s financial credibility is being rebuilt around enforceability—not just promise. As the Act takes effect and the global community watches, the real question is whether the government will apply these laws impartially — especially against the well-connected and politically exposed. Because grey-listing may be a stain, but it’s also the mirror revealing whether Kenya’s institutions have the courage and capacity to be truly accountable in a cashless, borderless world. Stay tuned for our next post as we continue to explore these developments and their implications!

References:

Institute for Security Studies Risk and reward of Kenya’s push to reverse FATF grey-listing

The FATF Jurisdictions under Increased Monitoring – 13 June 2025

Thomson Reuters AI, other technology the “only answer” to AML challenges in evolving threat landscape, says ACAMS report

ENACT IFFs and money laundering / Can anti-money laundering amendments get Kenya off FATF’s grey list?