The debt-to-GDP ratio is a crucial metric for assessing a country’s economic health. It is calculated by dividing a nation’s total public debt by its gross domestic product (GDP), then multiplying by 100 to get a percentage. This ratio indicates how much debt a country has relative to its economic output. The formula for the debt-to-GDP ratio is:

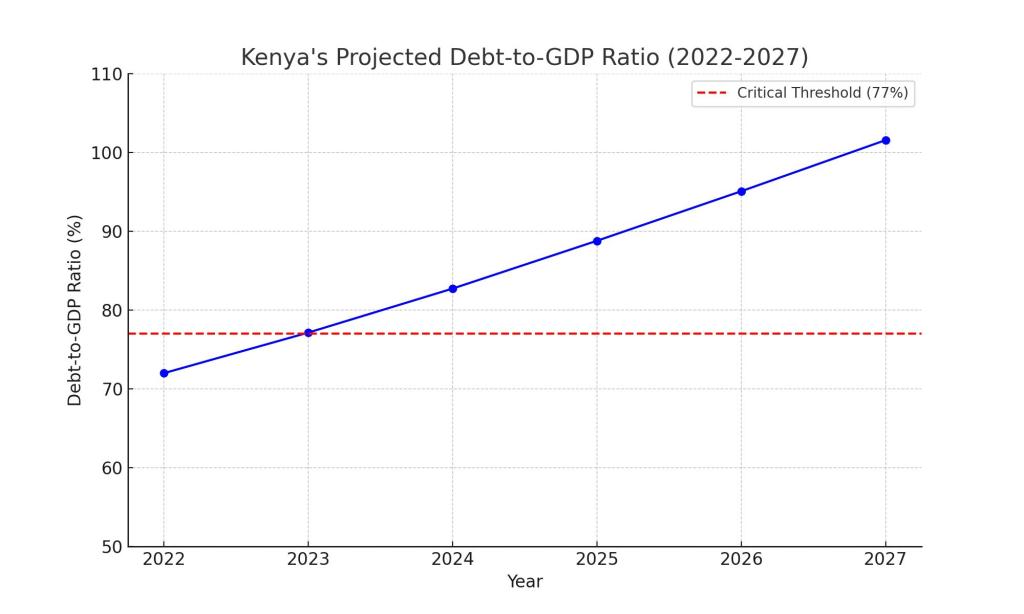

A high ratio suggests that a country may struggle to repay its debts, potentially leading to financial instability. For instance, Kenya’s debt-to-GDP ratio has been rising, with projections indicating it will exceed 100% by 2027.

In the context of Kenya, the debt-to-GDP ratio provides a snapshot of the nation’s financial challenges. According to the Corporate Finance Institute, a ratio above 77% can hamper economic growth. Kenya’s increasing debt, as highlighted in reports by Business Daily Africa and Reuters, signifies growing financial burdens, potentially leading to a debt repayment crunch. The high cost of debt servicing and external borrowing exacerbates these challenges, indicating a need for strategic financial management to avoid economic stagnation. The chart below indicates that Kenya’s public debt stands at KES 9.1 trillion as of early 2024, and projections from the Treasury expect it to cross KES 13 trillion by 2027.

To mitigate Kenya’s rising debt-to-GDP ratio without increasing taxes, several strategies can be employed:

- Boosting Exports: Enhancing the competitiveness of Kenyan goods and services can increase foreign exchange earnings, reducing the need for external borrowing.

- Encouraging Foreign Direct Investment (FDI): Attracting FDI can provide the necessary capital for development projects without increasing debt.

- Improving Public Sector Efficiency: Streamlining government expenditures and reducing wastage can free up resources for debt repayment and development initiatives.

- Diversifying the Economy: Investing in various sectors, such as technology and agriculture, can create new revenue streams and reduce reliance on debt.

Implementing these strategies can help stabilise Kenya’s economy and reduce its debt burden, fostering sustainable growth. Effective management of public resources, coupled with strategic economic policies, is essential to achieving a healthier debt-to-GDP ratio and ensuring long-term economic stability for Kenya.

References:

Business Daily Treasury expects debt to cross Sh13trn by 2027

Economist Intelligence Kenya faces a potential debt repayment crunch in 2024

Reuters Kenya’s double-digit debt costs sign of the tough times

CFI Debt-to-GDP Ratio

The Commonwealth Blog: Rising government debt-to-GDP ratios need urgent response

TheStreet What Is a Debt-to-GDP Ratio? Definition, Calculation & Importance

Cytonn Kenya’s Public Debt Review 2023: Is Kenya’s Public Debt Level Sustainable?