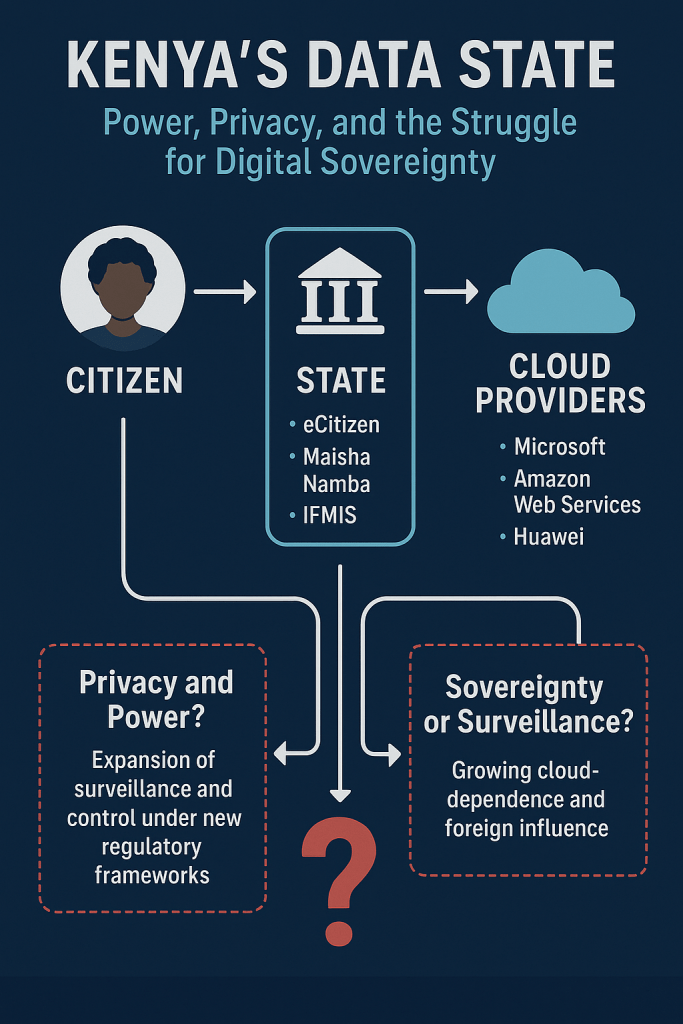

Kenya is watching itself — pixel by pixel. Over the last five years, the country has built an unseen digital nervous system linking thousands of Huawei-powered Safe City cameras, police databases, and social-media monitoring tools. From downtown Nairobi to Mombasa’s seafront, every movement can be captured and cross-checked within seconds at the National Police Service Command Centre. Officials hail this as “smart security”; critics call it the birth of an algorithmic state. It is now evident that Kenya’s system is among the most extensive in sub-Saharan Africa — facial recognition, automatic number-plate readers, and voice analytics feeding a real-time surveillance web. Civil-rights groups such as Article 19 Eastern Africa warn that the same technologies meant to protect citizens are increasingly used to watch them, often without consent or transparency.

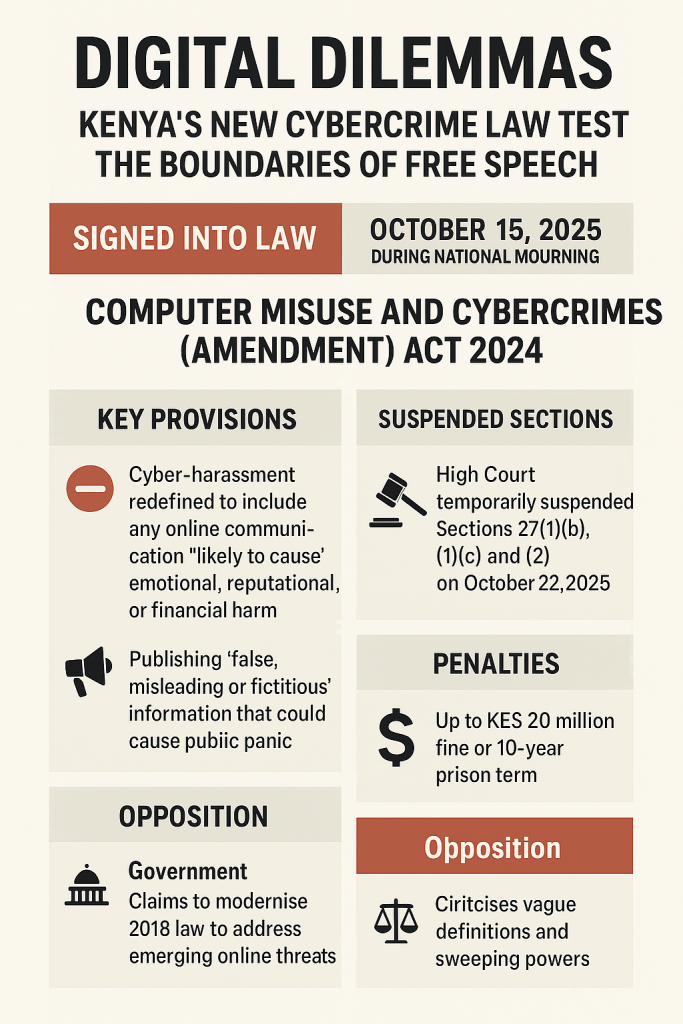

The legal architecture meant to contain this power is full of blind spots. The Cybercrimes (Amendment) Act 2024 widened government interception powers and allowed the Communications Authority to pull down online content on loosely defined “security” grounds. Meanwhile, the National Intelligence Service runs data-fusion platforms that combine SIM registration, mobile-money, and tax records — none of which fall under the Data Protection Act’s civilian oversight. The Office of the Data Protection Commissioner cannot audit national-security operations, leaving surveillance programs completely opaque. As the Kenya Human Rights Commission noted in an April 2024 brief, “privacy protections collapse precisely where the State holds the most data.” In the name of safety, a culture of monitoring has replaced a culture of accountability.

Kenya’s experiment is shaping regional norms. The Huawei model first tested in Nairobi has now appeared in Ethiopia, Uganda, and Tanzania, while Western donors — from the EU to Interpol — fund “cyber-capacity” projects that quietly expand the same infrastructure. Analysts describe this as a surveillance compromise: Eastern hardware, Western money, African data. What began as a modernization effort has become a mirror of global power politics — a democracy borrowing the tools of autocracy to stay secure. Unless Parliament enacts a Surveillance Oversight Law and empowers independent audits, Kenya risks institutionalizing fear as policy. The technology that promised protection now records obedience, and in this new digital republic one truth persists: the cameras no longer blink — they remember.

References:

Article 19 Eastern Africa Surveillance, data protection, and freedom of expression in Kenya and Uganda during COVID-19

The Kenyan Wall Street Kenya Upgrades Cybercrime Law to Hand Gov’t Sweeping Powers to Block Websites

The Star Controversial Cybercrime Act: What they said

Huawei Safaricom:Enhancing Security in Kenya with Huawei’s Converged Command & Control Solution

Africa – China Reporting Project Huawei’s surveillance tech in Kenya: A safe bet?

Coda Story In Africa’s first ‘safe city,’ surveillance reigns

The Conversation State surveillance: Kenyans have a right to privacy – does the government respect it?

BBC Safe cities: Using smart tech for public security